The Fat MVP Challenge

Enterprise clients (+1,000 employees) only buy “Fat MVPs” — an initial version of your product that will take years and millions to build. Fat MVPs are anti-lean: you have to burn a lot of money before getting users feedbacks, increasing your time to product-market-fit in an unhealthy way. Hopefully in the recent years many alternatives to the Fat MVP have emerged. We’ve gathered them in this post in the hopes of helping early-stage founders better design their go-to-market strategy.

🧜♀️The Siren Call

As pre-seed and seed investors at Frst, we have been meeting and partnering with many founders building SaaS for Enterprise clients.

Enterprise clients definitely need better software and can afford it. They usually pay for Average Contract Value over $200k and will unlikely churn. With that ACV you will only need 3 to 5 clients to raise a neat Series A, and 500 to have a $bn company. Once you have a blue chip client, prospects will adopt a sheep-like behavior, thus easing the next sale. The trajectories of companies such as ThoughSpot or Collibra show how massive the reward of Enterprise SaaS can be.

The siren call is very strong. But the truth is that addressing the Enterprise segment kills the most important advantage entrepreneurs have when they launch a startup, the ability to quickly iterate on users’ feedback in order to reach Product Market Fit.

💀Long feedback loops kill startups

Enterprise SaaS have very long feedback loops for two reasons. One, sales cycles are outrageously long. That’s because people willing to buy your software will have to convince many people outside of their business unit to do so. Most of the time you won’t even have a direct sales relation with the final decision maker, whose personal agenda for political reasons can be misaligned with the success of the company. Two, Enterprise clients will ask for product customization, security, compliance and rights management (who can access the software) features that imply months of work from your engineering team.

Both these sales and product constraints go against the traditional way of building a startup: write the smallest amount of code that gives clients the highest level of value, observe how users use it and iterate fast with them until you reach Product-Market-Fit.

If you’re building something for which you can’t easily get a small set of users to observe — e.g. enterprise software — and in a domain where you have no connections, you’ll have to rely on cold calls and introductions. But should you even be working on such an idea?

Paul Graham

🐘 The Fat MVP

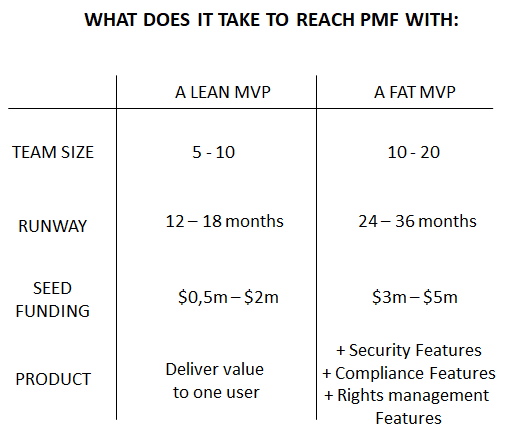

A Fat MVP calls for more resources than the traditional Lean MVP, and that’s why we tend to see Enterprise SaaS raise impressive rounds very early.

Because of this high barrier to entry, Enterprise SaaS have been mostly built by repeat entrepreneurs or experienced executives that could attract important funding in the first days of their companies. Here are a few examples of successful startups that took the Fat MVP way:

- Anaplan: Financial Planning & Analysis Software. Founded in 2008 by former founders of Adaytum that exited their previous company, Cognos, in 2002 for $160m. They raised +$6m in 2010, with 0 client signed. (sources 1, 2)

- Crowdstrike: Cloud Endpoint Protection: Founded in 2011 by former McAffee CTO. Raised a $26m stealth round in 2012 with Accel. (source)

- Thoughtspot: Business Intelligence / Analytics Software. Founded in 2012 by Ajeet Singh, former co-founder of Nutanix that IPOed in 2016. Raised a +$10m seed round with Lightspeed and has topped up c. $750m in funding since then. (source)

💸 How to build an Enterprise SaaS without a $5m seed round

At Frst we have been happily involved in large pre-product seed rounds raised by very experienced teams. You can trust me when I say that we will always be eager to partner with this kind of teams in the future.

But +90% of founders cannot raise $5m before launching their product. First-time founders with less than 5 years of work experience and without “Enterprise experiences” will have an hard time convincing VCs to fund them.

When we find ourselves in this situation, we try to understand with founders how to avoid building a Fat MVP. We then start exploring alternative Go-To-Markets, and our conversation takes a very familiar pattern. We have shared here this pattern, hoping it will help founders consider all their options before choosing to address Enterprise clients directly.

GTM #1: Go Upmarket

Going Upmarket is the traditional and probably the most efficient way for SaaS companies to end up selling large contracts to Enterprise clients.

It goes like this: instead of targeting Enterprise clients first, start with the lower end of your market (Small and Medium Businesses) to accelerate the feedback loop. SMBs have shorter sales cycles and lower product requirements. As you gain maturity and funding, you will be better equipped to build an Enterprise ready-product and the appropriate sales organisation.

Many companies have followed this path, in part because most SMB SaaS decide to go upmarket when they see their clients CAC growing up. Intercom is a famous example.

Caveat: The problem with the Upmarket GTM is that many pain points only exist in large companies and will only exist in a toned-down version in a smaller company. And a low pain point means unattractive startup opportunities. The Upmarket GTM is by far not a silver bullet. A few examples of Software categories that solve a deep pain point for Enterprise clients but not for SMBs:

- Business Travel Management Software (Tripactions, Travelperk)

- Financial Planning & Analysis (Anaplan, Adaptive Insights)

- Vulnerability Management Software (Tenable, Qualys)

- Sales Conversation Improvement (Gong.io)

- Internal Data Search (Thoughtspot)

GTM #2: Create a Bottom-up adoption process

A Bottom-up GTM means building a product that can be used without the approval of the top of the organization. There are mainly two Bottom-up motions: 1/ Self-served SaaS and 2/ Open Source Software.

2.1 Self-served SaaS

Bottom-up SaaS have products that can be self-served. They are very simple to use and straight-forward to set up. Most of the time they are accessible through a free trial or a freemium business model.

That way, single users inside large organizations can try and spread the product without the approval of the top of their company. After a certain level of usage, users will ask their managers to pay in order to get full access to the product.

Bottom-up GTM completely flips the traditional sales process. Sure, you will still need Enterprise Sales to turn usage into revenue, but sales discussions will be based on Product usage, not PowerPoint presentation, resulting in shorter sales cycles and reducing the Sales & Marketing resources SaaS need to invest in order to close Enterprise clients.

Slack has mastered how to turn a strong bottom-up adoption into an Enterprise lead generation tool. As explained here by Jason Lemkin, the company went from no revenue from Enterprise clients in 2015 to +40% of its revenue coming from customers paying more than $100k ACV at its IPO in 2019.

Caveat: However not all products can adopt this GTM. In order to be adopted by the Bottom of the organization, those products need to be self-served. Their user experience feels like a B2C product: they don’t require manual onboarding, training or integrations with other software. Important software categories are de facto excluded from being Bottomed-up: ERP, Business Intelligence Tools, Data Catalogs and Lineage, etc.

2.2 Open Source Software

OSS has a particularly strong fit with Enterprise clients. Large companies are reluctant to buying SaaS as they fear vendor lock-ins and cloud security threats. As a result OSS has built its business model around Enterprise clients, be it with the Opencore model (selling Enterprise-specific features on top of the OS technology) or the Redhat model (selling Professional Services to Enterprise users).

Plus, as explained by Mike Volpi in his article How open-source software took over the world, OSS intrinsically has a bottom-up motion, reducing sales cycle and yielding great unit economics, making it the perfect weapon to enter large companies:

Because so much of the initial adoption of open-source software comes from developers organically downloading and using the software, the companies themselves can often bypass both the marketing pitch and the proof-of-concept stage of the sales cycle. The sales pitch is more along the lines of, “you already use 500 instances of our software in your environment, wouldn’t you like to upgrade to the enterprise edition and get these additional features?” This translates to much shorter sales cycles, the need for far fewer sales engineers per account executive, and much quicker payback periods of the cost of selling.

Mike Volpi

As a result companies with +10,000 employees use open-source software almost twice as much as all companies regardless of their size (63% versus 37%, according to this survey realized by the Linux Foundation in 2018).

Caveat: Unfortunately neither is OSS a silver bullet. 1/ This GTM only works if you are solving a technical problem, owned by developers, and 2/ In the early days, it’s super hard to foster a developers community that will help you build your software.

GTM #3: Engage Enterprise clients through Professional services

According to Martin Casado in his article The Case for Services in Enterprise Software Startups, billing professional services is a very good entry point to Enterprise clients. It enables you to build trust and collect users feedback while extending your cash runway.

If Bottom-up disrupts the traditional Enterprise Sales Go-To-Market from the bottom, selling professional services disrupts it from the top.

This tweet from Chetan Puttagunta at Benchmark shows how Workday and Veeva, two famous Enterprise SaaS, started with billing professional services and reduced its share in favor of software licences as they scaled:

Caveat: However this two-step strategy (service, then software) can be very hard to handle for founders with SaaS and Product background. And as learning how to build a service company takes energy and time, we believe going Upmarket or Bottom-up motions can be better GTM fit for first-time founders.

If these three GTM alternatives aren’t valid options for your business, you might want to consider addressing Enterprise clients directly, and build a Fat MVP. The next two subsections are ideas to make your Fat MVP leaner and decrease the $ amount you will have to get from VCs.

GTM #4: Target Tech companies first

David Sacks made an interesting point in that tweet:

Scale-ups and large technological companies are better software buyers than traditional companies and in 2020 they are numerous enough to form a market on which to build unicorns. Working with them will reduce sales cycles and thus your time to PMF. This strategy, by the way, works for both SMB and Enterprise SaaS, and has been adopted by almost every startup in our portfolio.

A good (and French 💪) example of this strategy is Dataiku. Dataiku is a Data Science Platform that helps data analysts and scientists collaborate in order to put AI in production faster. This software makes sense for large businesses, that have large data teams and collaboration issues. As described in this article (in French), the company started in 2014 its beta program with Tech companies: Ventes Privées, Cdiscount, Fotolia, Cityvox.

Caveat: VC-backed Tech companies are particular animals with a lot of cash. For that reason they can have low price sensitivity. And as they build high-margin business, improving their productivity even by 1% creates important economic output. All to say you might want to keep a close eye on not over-fitting your proposition value and go-to-market for Tech companies, which can lead to a Total Addressable Market problem if you start your business outside of Silicon Valley.

GTM #5: Build on top of the platforms already used by Enterprises to reduce your time to market

Building your MVP on platforms already used by your prospects (Slack, Salesforce or Monday for example) can be a very efficient way to prove user interest without spending too much time and money on building your product infrastructure (as you leverage the platform infrastructure).

The age-old question of the viability of building successful startups within a third-party platform would require several independent blog posts. Veeva, which runs on Salesforce’s app development platform and has a c. $30bn market capitalization as we speak is a living example that it is possible (for more details on this amazing story I suggest you read Veeva S1 analysis written by Tomasz Tunguz).

Leveraging an existing platform can help you show traction and prove PMF without spending years on building a Fat MVP ; even if you might have to rework the MVP into a standalone product later on.

I am pretty sure many alternatives to the Fat MVP are not mentioned in this article. If you have one in mind please share it in the comment section, I would love to integrate it in this post so founders have all cards in hand before addressing directly Enterprise clients.

Many thanks to @Pentremont and @maximejledante for taking the time to carefully review early boring versions of this post ;)