Discover more from What's Hot 🔥 in Enterprise IT/VC

What's 🔥 in Enterprise IT/VC #363

Thoughts + 🙏🏼 on 🇮🇱 ... b4 regularly scheduled programming: Loom exit, seed valuations...

Hi all, before I dive into my usual thoughts and rants on enterprise IT/VC, I wanted to zoom out and discuss humanity. The situation in Israel 🇮🇱 is not about politics; it’s about being human and condemning heinous acts of terrorism by Hamas on Israeli civilians. Here’s the official statement from my firm.

If you want to know what it’s like to grow up in 🇮🇱, read this from Ohad Maishlish, co-founder of Env0, one of our portfolio companies.

To that end, it’s nice to see the venture community supporting in the little ways that we can first by speaking out and second by taking action. Recently over 500 VC firms joined together to support Israel and condemn terrorism and Hamas - more from Alex Konrad at Forbes:

In the letter, the firms, mostly based in the U.S., agreed to “stand united” in support of Israel, its people and tech community, which it noted had long been a partner to the global “innovation ecosystem.” It condemned “senseless and barbaric acts of terrorism,” saying the signatories “bear witness to the devastation they’ve wrought” and deploring the loss of innocent lives. The statement went on to call for the return of hostages and normalcy for Israel’s startup community.

The joint statement comes amid a nearly weeklong stretch of historic violence that saw more than 1,200 Israelis killed in terror attacks perpetrated by Hamas, thousands of others displaced, and dozens reportedly held hostage in Gaza. Another reported 1,100 Palestinians have been killed in retaliatory strikes there so far.

“In the spirit of peace and unity, we encourage the global venture community to support and engage with Israeli startups, entrepreneurs and investors as they navigate through these challenging times,” the statement said. “We believe in a brighter and more prosperous future for the region. Will continue to enable the talented entrepreneurs and startups in Israel and abroad to continue their vital work in shaping a better future for all.”

If you want to join me in donating to humanitarian relief efforts, please contribute to United Hatzalah and the Israel rescue efforts. If you want to volunteer any time to Israeli startups who are short-staffed, please sign up here.

Now back to our regularly scheduled program…

IMO the big startup news of the week was Atlassian announcing the acquisition of Loom for a whopping $975M! Ok, let’s just call it $1B for arguments sake. There are lots of thoughts on the subject from it’s a smashing success to wow, it’s a down round from the last reported $1.53B valuation.

IMO any company that goes from zero to $975M exit in 8 years on $175M raised should be 👏🏼👏🏼👏🏼 and is a smashing success!

Insane metrics and user growth…so who made money?

Here’s the breakout from Phil Haslett:

VC returns for the $975M Loom sale to Atlassian

- Seed 1: 64x ($40M on $622K)

- Seed 2: 25x ($78M on $3.1M)

- Series A: 12.5x ($134M on $10.7M)

- Series B: 4.5x ($125M on $28.1M)

- Series B+: 2.3x ($55M on $23.5M)

- Series C: 1.0x* ($130M on $130M)

These are impressive numbers for the early investors, and of course, for the founders since after accounting for the approximate $562M of investor returns, the remaining $413M is to be distributed to founders and employees. This is not dissimilar from Instacart numbers where the early investors up to Series B were in the money at the initial IPO price.

IMO, the Series C also wins with a return of capital. First, I strongly believe that many 🦄 will never return all of the capital invested so a 1x return is huge. Second, venture firms have a “recycling” clause which allows them to reinvest distributions received up to 15-20% of the fund size which allows these funds to be fully invested to account for management fees paid over the life of the fund. By returning capital quickly after only 2.5 years, these growth investors can reinvest this into another company that may be more appropriately priced to seek a better return. If the best you will ever get is 1x from an overpriced growth investment, it’s better to get the capital back sooner to have a chance to get a return somewhere else.

Everybody wins here - huge congrats to Loom!

There is one other lesson here for founders. While I don’t know what the revenue numbers are for Loom, I’m assuming that Atlassian paid a hefty “strategic” multiple for the business because it plans on incorporating Loom into every single one of its products!

As Atlassian consolidates Loom into its platform, engineers will soon be able to visually log issues in Jira, leaders will use videos to connect with employees at scale, sales teams will send tailored video updates to clients, and HR teams will onboard new employees with personalized welcome videos. By integrating Atlassian’s and Loom’s investments in AI, customers will be able to seamlessly transition between video, transcripts, summaries, documents, and the workflows derived from them.

Loom will remain available as a standalone product, and once the acquisition is complete, we’ll be integrating it across our suite of tools so customers will be able to add context to the work they are doing everywhere. For customers looking to purchase Loom now, see here.

Founders if you want a strategic price, let me remind you how you do that 👇🏼

As Vinay states:

We have been building a relationship with @mcannonbrookes and @scottfarkasfor many years. Atlassian has been a true believer in Loom since our early days, and myself and @yoyo_thomas think this acquisition marks the beginning of a critical breakout growth chapter for Loom.

Founders if you haven’t been staying in touch with the handful of potential strategic buyers in the future, play the long game and start building those bridges now…just in case.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

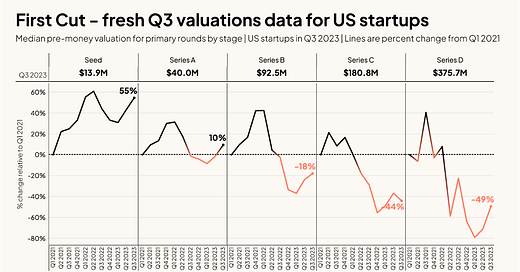

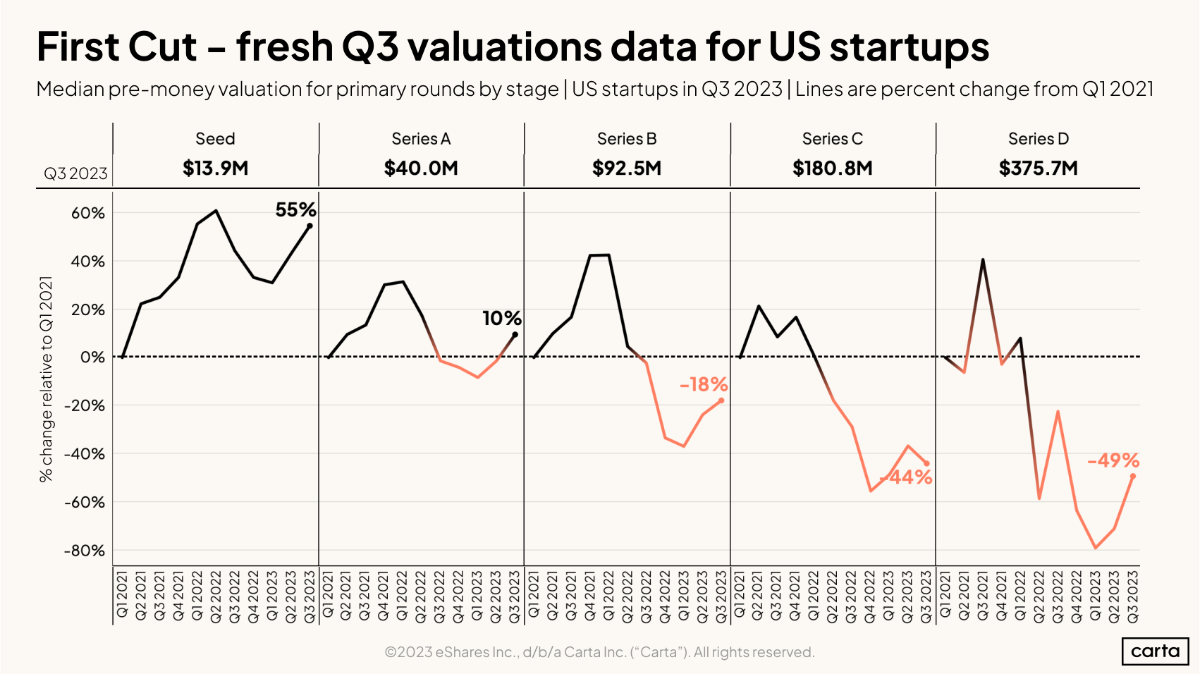

Latest Q3 Carta data is out and as compared to Q1 2021, seed is only round where valuations are materially 📈 - why? It’s the race to be first I’ve written about before and safest place to be…

I also wrote about this trend and “The race to be first” in Dec 2020

❤️ this from cofounder of Linear - I’d say this is beyond just taste, you need to know what great looks like for hires and all functions as well

🎙️ Great interview on The Tim Ferriss Show with Arnold Schwarzenegger on 7 Tools for Life, Thinking Big, Building Resilience - never think small - think big and bigger (starts at 27’53”)!

Enterprise Tech

State of AI Report 2023, 6th Edition is out - key takeaways from the author

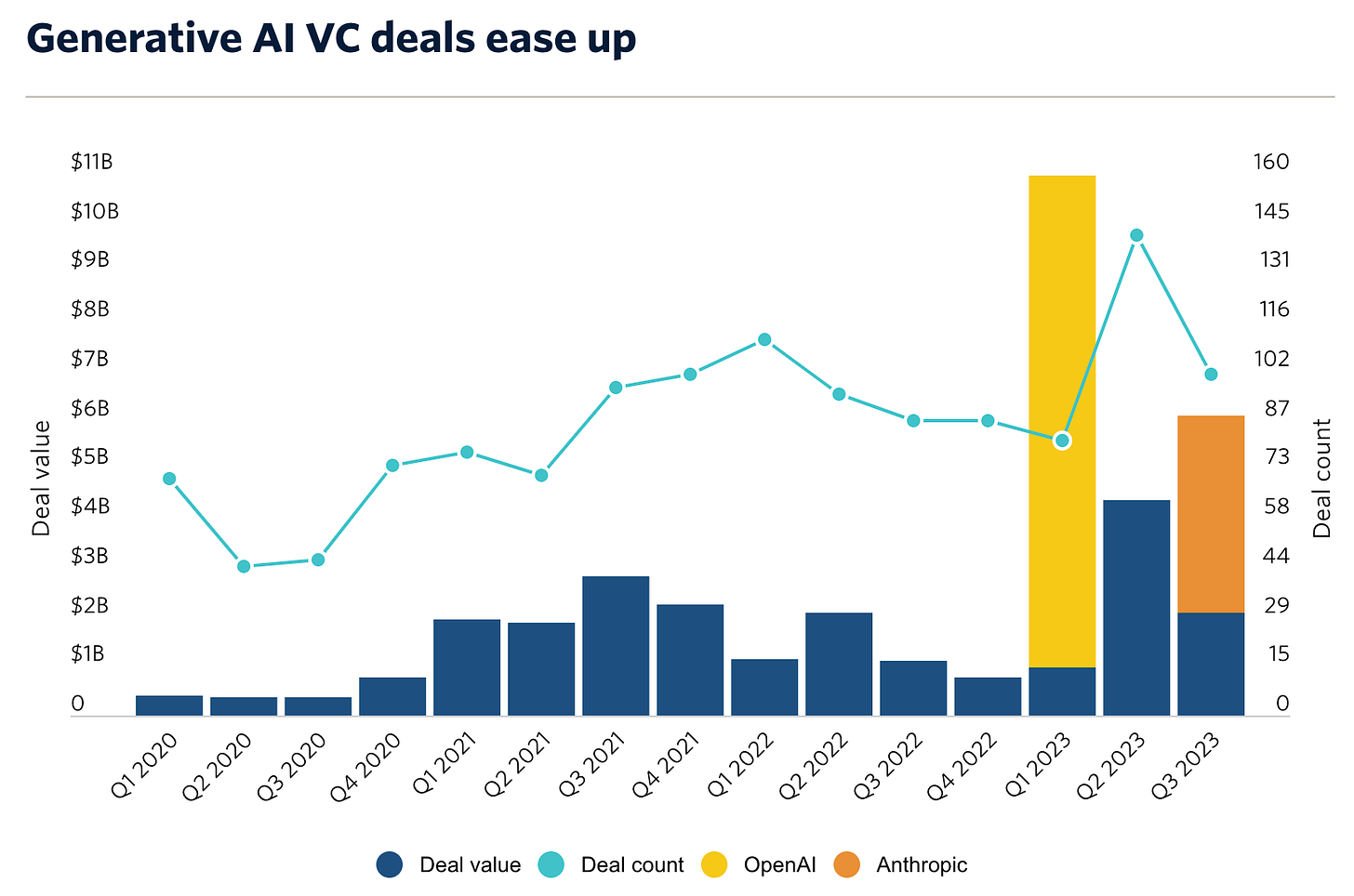

Generative AI VC investment slowing down in terms of number of companies - outliers are OpenAI and Anthropic (Pitchbook) - VCs more discerning and as you know, I don’t really know what a Generative AI co really is, as any company will leverage LLMs if the tech can dramatically improve productivity AND if customers are willing to pay for it

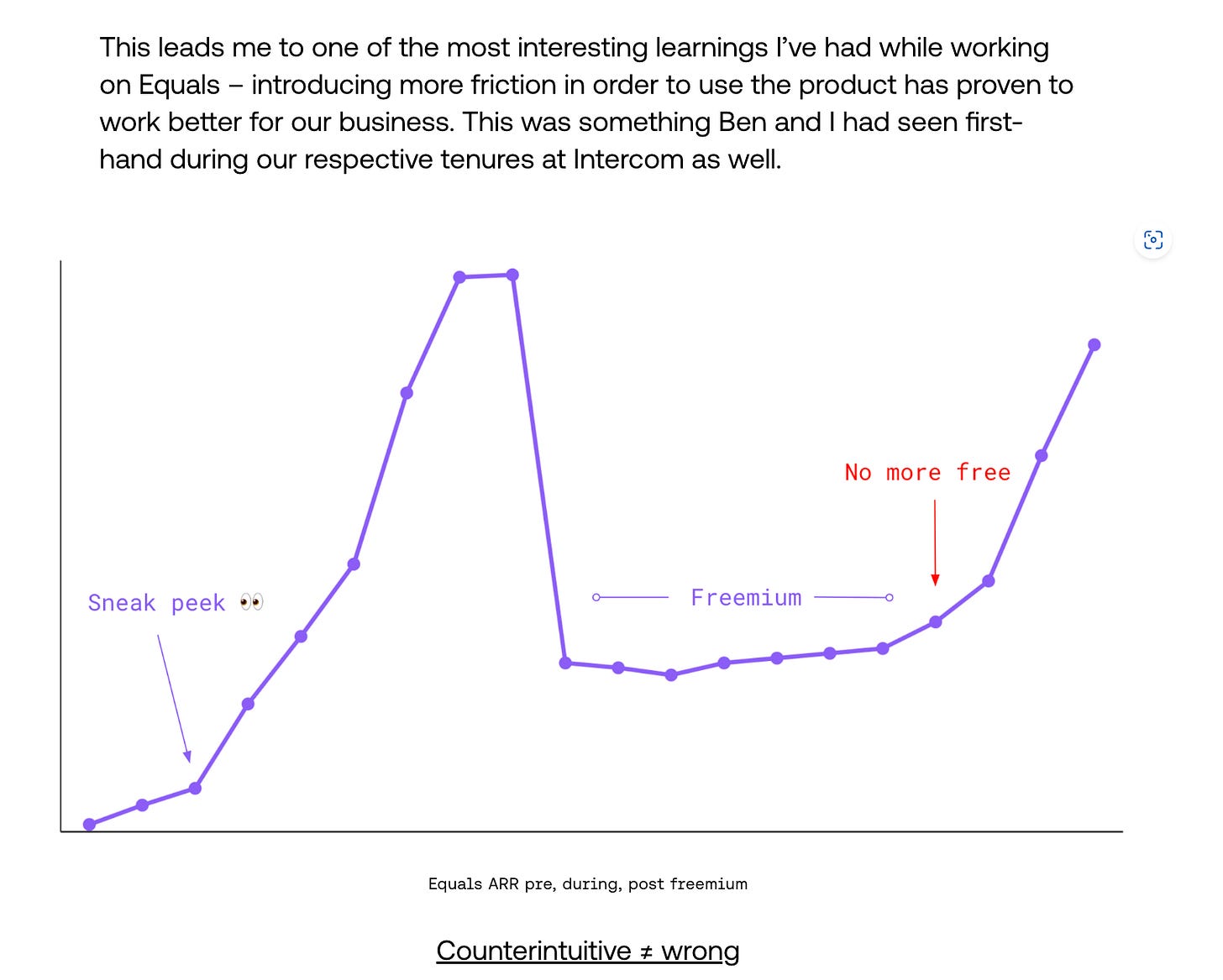

👇🏼 The fallacy of freemium in SaaS (Bobby Pinero - story after raising $16M Series A from a16z) - as I said a couple of weeks ago, easy onboarding = easy off boarding - here Bobby shares how some friction makes a huge improvement since investment of some time from user/customer = better conversions

Also check out What’s 🔥 #361 from 2 weeks ago as I dive deeper into why the rage around PLG + premium valuations is over.

Metrics that matter for LLM Inference Performance along with tradeoffs (Databricks/MosaicML eng team)

So, how exactly should we think about inference speed?

Time To First Token (TTFT): How quickly users start seeing the model's output after entering their query. Low waiting times for a response are essential in real-time interactions, but less important in offline workloads. This metric is driven by the time required to process the prompt and then generate the first output token.

Time Per Output Token (TPOT): Time to generate an output token for each user that is querying our system. This metric corresponds with how each user will perceive the "speed" of the model. For example, a TPOT of 100 milliseconds/tok would be 10 tokens per second per user, or ~450 words per minute, which is faster than a typical person can read.

Latency: The overall time it takes for the model to generate the full response for a user. Overall response latency can be calculated using the previous two metrics: latency = (TTFT) + (TPOT) * (the number of tokens to be generated).

Throughput: The number of output tokens per second an inference server can generate across all users and requests.

Our goal? The fastest time to first token, the highest throughput, and the quickest time per output token. In other words, we want our models to generate text as fast as possible for as many users as we can support.

Yep - way too many AI infra tools cos from Victor Mota 🧵 - value will accrue in application layer for many and IMO this means incumbents in the long run…however there will be some areas to carefully explore like net new, unimagined apps or where incumbents just can’t/won’t build which is quite rare IMO. All that being said, every application that should have AI embedded into its feature set will have AI embedded into its feature set so I wouldn’t call any of these cos an AI company as its just default.

Controversial take, but at this point in the cycle LLM wrappers or applications may actually be a better opportunity than LLM ops/infra/tools:

- Things are changing so quickly that building your product around an architecture or pattern that might not be relevant in 3 months is rough.

- The engineer's tendency to prematurely optimize and build the general abstraction is leading to everyone in the space going for the infra or framework opportunity. There might be more libraries than applications right now. At some point you have to go and do something with all the picks and shovels…

AI ain’t cheap as customers eventually have to pay and according to comments made to WSJ, Microsoft and others are losing money for every paying user (WSJ)

Individuals pay $10 a month for the AI assistant. In the first few months of this year, the company was losing on average more than $20 a month per user, according to a person familiar with the figures, who said some users were costing the company as much as $80 a month.

Microsoft and GitHub didn’t respond to requests for comment on whether the service is earning money. The profitability picture for GitHub Copilot and other AI-powered assistants will change if computing costs come down.

However Nat Friedman, former CEO of Github, disagrees…

🤯 AI Kendall is pretty legit! Imagine the deep fakes in the future? Must watch

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups